Recent data reveals Coinbase Global is on the brink of holding 1 million bitcoins, requiring just an additional 5,019 bitcoins to cross this significant milestone. In the preceding fortnight, Coinbase has witnessed its bitcoin reserves grow by 16,404 bitcoins, inching closer to this noteworthy threshold.

Coinbase on Cusp of 1 Million Bitcoin

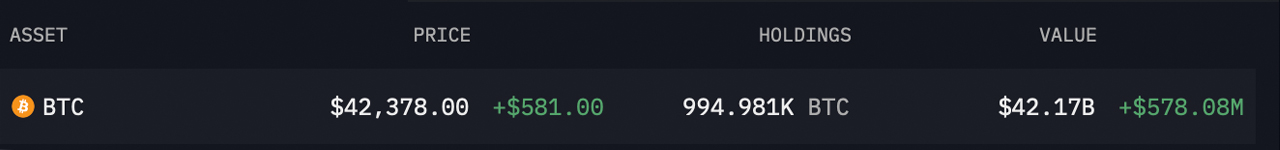

Coinbase (Nasdaq: COIN) is edging nearer to the 1 million bitcoin mark, currently possessing 994,981 BTC valued at $42.17 billion. Trailing only behind Satoshi Nakamoto, Coinbase stands as the most substantial bitcoin holder in the industry. Over the recent two weeks, the exchange observed a deposit of 16,404 bitcoins, amounting to $694 million. Meanwhile, Coinbase Pro, the firm’s trading platform, recorded a withdrawal of 4,624.56 BTC, as indicated by its 30-day outflow data.

There’s a significant flurry of activity among the ten new U.S.-based spot bitcoin exchange-traded funds (ETFs). Since Jan. 12, 2024, Grayscale’s GBTC reserves diminished by 114,367.39 BTC, while the other nine ETFs collectively accumulated 132,170 BTC since their inception. Notably, every single ETF, except for Vaneck and Fidelity, relies on Coinbase for custodial services. This reliance likely contributed to the modest increase of 16,404 bitcoins in Coinbase’s BTC reserves since Jan. 13.

The eight ETFs using Coinbase’s custodial services may have facilitated offchain swaps, with Coinbase acting as the sole intermediary. If the BTC deposit trend at Coinbase persists, the platform is poised to reach the 1 million bitcoin milestone soon, needing only an additional 5,019 bitcoins. Coinbase’s present holdings represent 5.07% of the total circulating supply of 19,611,049 bitcoins and constitute 4.73% of the overall 21 million bitcoin supply cap.

Separate from Coinbase’s custodial activities, other exchanges have experienced a bitcoin influx since January’s onset. According to cryptoquant.com, exchanges held 2,087,030 BTC on Jan. 1, 2024, which has risen to 2,100,984 BTC today, marking a 13,954 BTC increase over the last 28 days. Rising BTC reserves in exchanges generally suggest increased selling pressure, while substantial withdrawals imply the contrary, reducing liquidity in the market.

What do you think about Coinbase nearing the 1 million bitcoin mark? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/Gqrz1cW

Comments

Post a Comment