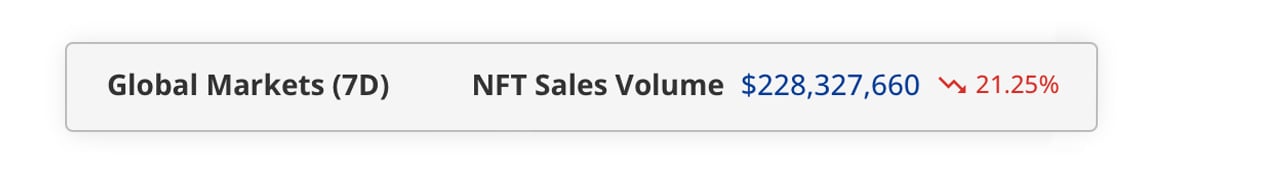

In the span between Jan. 20 to Jan. 27, 2024, there was a notable decline in the sales volume stemming from non-fungible tokens (NFTs), plunging 21.25% from the week before. The leading blockchains in seven-day sales, Ethereum and Bitcoin, experienced substantial decreases, ranging from 28.78% to 12.62%, respectively.

NFT Market Faces Sharp Decline

At the onset of 2024, NFT sales dipped by 1.31%, falling below the last week’s figures of 2023. The subsequent week witnessed a marginal rise in NFT sales, approximately 0.05%, but last week experienced a 5.05% drop in digital collectible sales.

This week marked the steepest decline in 2024, with sales plunging over 21% compared to the previous seven days. According to metrics from cryptoslam.io, the total amounted to $228,327,660.

This downturn contrasts with the year-end surge in NFT sales during 2023, largely driven by Bitcoin blockchain-based NFT transactions. In November and December of 2023, Bitcoin’s NFT sales dominated, continuing to lead in the first week of January 2024.

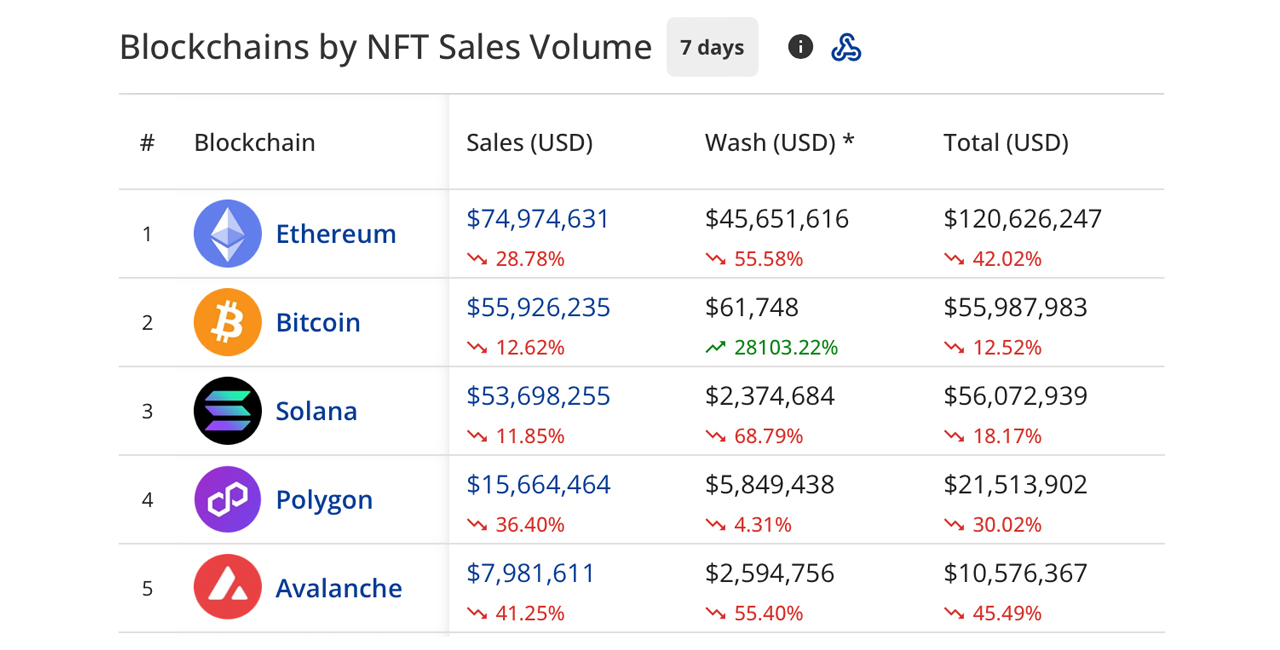

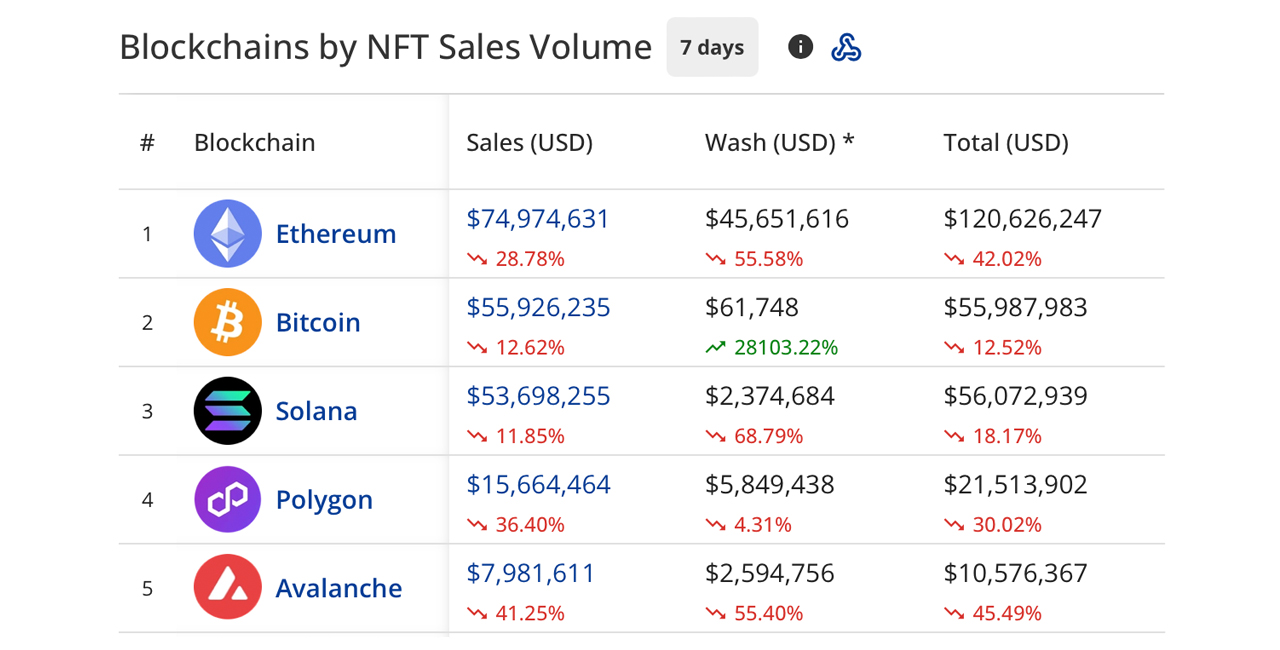

However, recent weeks have shown a shift, with Ethereum reclaiming its position as the frontrunner in NFT sales volume. Over the past seven days, Ethereum’s NFT sales amounted to $74.97 million, marking a 28.78% decrease from the previous week.

Meanwhile, Bitcoin experienced a 12.62% week-over-week drop, with $55.92 million in sales over the same seven-day period. Solana secured the third rank, recording $53.69 million in sales, which is a decrease of 11.85%.

Polygon’s NFT sales claimed the fourth position, amounting to $15.66 million, yet experienced a 36.40% drop. In the fifth spot, Avalanche garnered $7.98 million in sales, with a notable 41.25% decline in its NFT market.

All five of the top blockchains leading the week’s sales saw double-digit losses. Among the top ten this week, Ronin, notably the blockchain supporting Axie Infinity, witnessed a significant 209.09% surge, achieving $1.76 million in NFT sales.

High-Ranking NFT Collections and Top Sales

In the realm of unique digital collectible collections, the Cryptopunks series clinched the highest position in sales this week. Cryptopunks amassed $13.67 million in sales during the past seven days, marking an increase of 32.23% from the previous week.

Bitcoin’s Uncategorized Ordinals experienced $9 million in sales, witnessing a 3.75% decline from the week prior. In the third spot, Solana’s Froganas reported $7.04 million in sales, a significant increase of 420.77% compared to last week.

Occupying the fourth rank, Solana’s Cryptoundeads achieved $6.75 million in sales, yet faced a 58.82% decrease. In the fifth position, Avalanche’s Dokyo NFT collection registered $5.85 million in sales, experiencing a 33.70% drop in sales volume from the previous week.

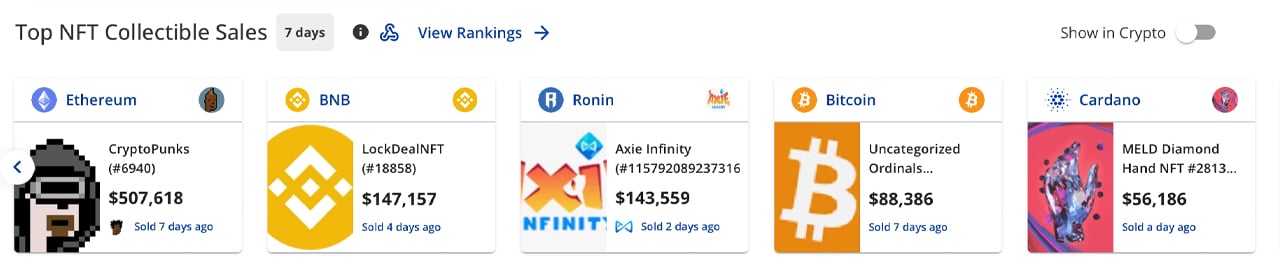

The past week’s highest-priced digital collectible was Cryptopunk #6,940, fetching $507,618 seven days ago. BNB’s Lockdealnft #18,858 realized a sale of $147,157 four days ago, while an Axie Infinity NFT commanded a price of $143,559 this week.

An Uncategorized Ordinal was acquired for $88,386, and a Cardano’s Meld Diamond Hand #2,813 went for $56,186. The sales of Cryptopunk #6,940 and the Axie Infinity NFT contributed significantly to the sales boost on their respective chains.

Sales of blockchain-based digital collectibles faced a challenging period throughout 2022, and most of 2023 also witnessed a downturn in NFT sales until the year’s end. Bitcoin’s entry into the NFT sales arena initially boosted overall sales, but BTC-focused NFT sales not only decreased this week but also experienced a 28.15% drop the week before.

NFTs based on Solana and Polygon showed an increase in the latter part of 2023, yet they have recently encountered modest falls in their overall digital collectible sales volume. Whether this downward trend in NFT sales continues or a resurgence occurs remains to be seen.

What do you think about this week’s NFT sales action? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/dIcbrpt

Comments

Post a Comment