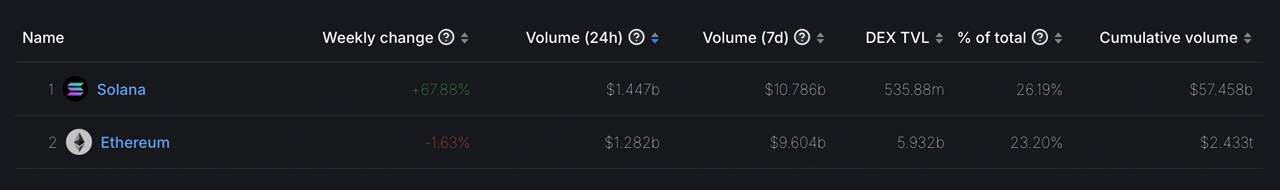

Recent statistics reveal that in the last week, decentralized exchange (dex) platforms built on Solana have surpassed Ethereum in market performance. Data indicates that Solana-based dex platforms achieved a volume of $1.447 billion in the past day, overshadowing the $1.282 billion recorded by Ethereum trading platforms.

Solana Surges Past Ethereum in Dex Volume

Solana’s recent price surge, coupled with a multitude of airdrops, has propelled the layer one (L1) blockchain’s dex volumes to new heights. Conversely, trade volume for solana (SOL) on centralized exchanges lags behind that of Ethereum. Data from Deflllama.com confirms that both the 24-hour and weekly dex volumes for Solana have exceeded those of Ethereum.

Recent data shows Solana platforms’ daily dex volumes have surged to $1.447 billion, marking a 12.87% increase over Ethereum dex applications’ $1.282 billion. Over the past seven days, Solana’s decentralized exchanges have amassed $10.786 billion, overtaking Ethereum’s $9.604 billion in weekly dex volumes. Notable contributors to these volumes are dex platforms like Raydium, Orca, Lifinity, Phoenix, Openbook, and Mango Markets, along with significant activity on Drift, Crema, and Saber.

A considerable portion of SOL-based dex protocol trading volume was recorded on Dec. 21, 2023, largely fueled by recent Solana airdrops and SOL’s substantial 40% increase over the previous week. Over the past year, SOL has demonstrated massive growth, escalating 895% against the U.S. dollar. The largest trading pairs on Raydium, Solana’s largest dex by volume, are listed as ANALOS/SOL, WIF/SOL, SILLY/SOL, and SOL/USDC.

Recent statistics underscore a significant trend in decentralized finance (defi). While Ethereum dex protocols remain a dominant force, Solana’s impressive daily volume and stats over the week signify a pivotal shift in dex market dynamics, spotlighting the growing influence of the Solana ecosystem.

What do you think about Solana dex volumes surpassing Ethereum’s dex volumes? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/7XyaqIY

Comments

Post a Comment