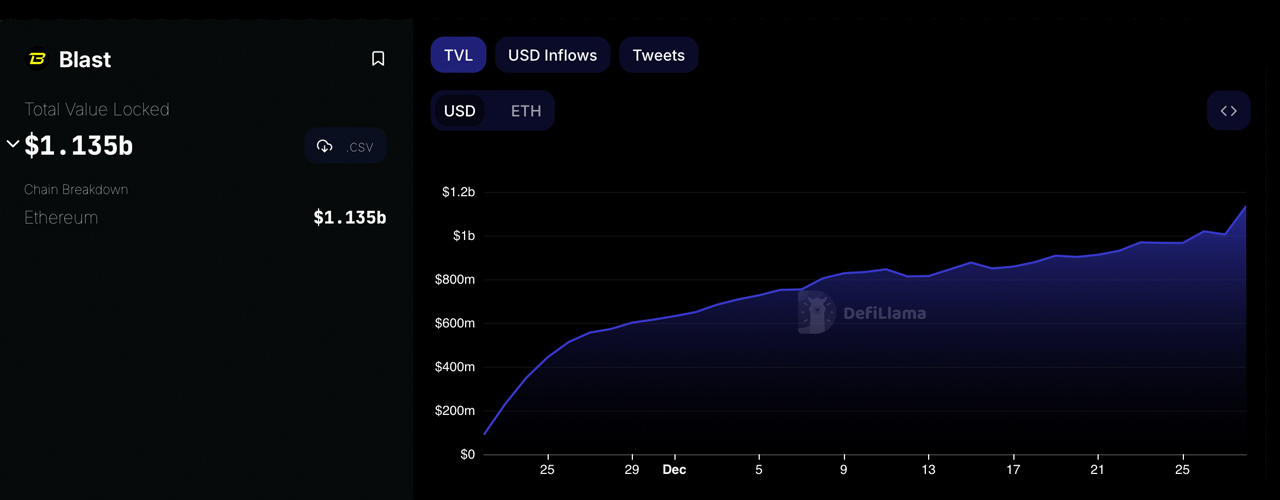

Statistics reveal that the Ethereum layer two (L2) platform Blast now secures over $1 billion within its protocol. The total value locked (TVL) in Blast has expanded more than twelvefold since its launch in late November.

Blast’s TVL Hits $1 Billion

Initially, on Nov. 22, 2023, Blast’s value locked was recorded at $89.59 million, but as of today, it has surged to $1.135 billion. Currently, Blast ranks as the 17th largest decentralized finance (defi) protocol in terms of TVL, nestled between Juststables and Marinade Finance, according to data collected by defillama.com.

The platform is distinguished by its native staking and strategies to amplify yield through ether (ETH) staking and real-world assets (RWAs). Pacman, the creator behind the non-fungible token (NFT) marketplace Blur, is credited with building Blast.

Blast received a boost through investments from Paradigm and Standard Crypto, yet an executive from Paradigm remarked that the Blast debut “crossed lines” concerning Blast’s launch messaging and execution. Additionally, the project faced accusations of being a Ponzi scheme, allegations which Pacman strongly denied.

Depositors in Blast earn around 5% interest on their locked funds within the defi protocol, alongside accruing points set to be redeemable for a forthcoming airdropped digital currency. However, users are unable to transfer or withdraw their locked funds from Blast until February 2024.

In a recent discussion with DL News, Joseph Liu, the founder of Nftperp, highlighted that the NFT platform Blur aims to integrate a decentralized perpetual futures exchange system for NFTs via Blast. Nftperp, a platform offering similar services, has recently secured $3 million in funding.

“We see them as our major competitor going forward,” Liu commented on Blur and Blast’s position in the market to DL News. After reaching the $1 billion mark, Pacman celebrated Blast’s achievement on the social media platform X.

“Incredibly excited to close out the year with this milestone,” Pacman said. “Web3’s power is that wins for protocols are wins for the entire community. However, I think much more can be done to make sure that value creation goes to the end-users who are the lifeblood of the onchain economy. Excited for next year.”

What do you think about Blast jumping past the $1 billion mark in terms of TVL? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/eEKmyza

Comments

Post a Comment