Rich Dad Poor Dad author Robert Kiyosaki has recommended buying bitcoin exchange-traded funds (ETFs). Warning that the global economy is slowing to a possible depression and the U.S. Treasury and Federal Reserve will print trillions in “fake dollars,” he urged investors: “Don’t be caught sleeping like most Americans. Take action now.”

Robert Kiyosaki and Spot Bitcoin ETFs

The author of Rich Dad Poor Dad, Robert Kiyosaki, has suggested investing in bitcoin exchange-traded funds (ETFs) for investors who prefer this approach over direct investment in bitcoin. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

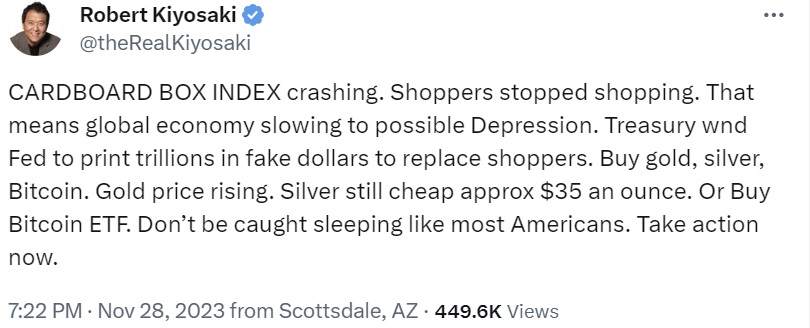

On Tuesday, Kiyosaki posted on social media platform X, expressing concern about the Cardboard Box Index, an indicator used by some investors to assess consumer goods production, which he claims is crashing. Kiyosaki stated that shoppers have ceased shopping, indicating a potential global economic downturn that could result in a depression. He anticipates that the Treasury and Federal Reserve will respond by printing trillions in fake dollars.

In response to these concerns, the renowned author recommended his usual choices of gold, silver, and bitcoin. He highlighted the rising price of gold and the relatively low cost of silver. Additionally, Kiyosaki suggested considering a bitcoin ETF as an alternative. In conclusion, he urged investors to take immediate action and avoid being caught off guard, emphasizing the need for proactive measures.

This isn’t the first instance of Kiyosaki warning about a potential depression. In July, he predicted that a depression is coming. In February, he cautioned about an impending giant crash, stating that a depression is possible. He projected that by 2025, gold would be valued at $5,000, silver at $500, and bitcoin at $500,000. Kiyosaki attributed these predictions to the anticipated loss of faith in the U.S. dollar, which he refers to as “fake money.” In his perspective, gold and silver are regarded as “God’s money,” while bitcoin is seen as “people’s money.”

Kiyosaki did not specify the type of bitcoin ETFs he recommends. In the U.S., there are futures bitcoin ETFs but the U.S. Securities and Exchange Commission (SEC) has yet to approve a spot bitcoin ETF. SEC Chairman Gary Gensler recently revealed that the securities regulator is considering between eight and 10 spot bitcoin ETF applications. Recently, a former NYSE president said he expects money to flood into the crypto industry with spot bitcoin ETF launches. Microstrategy chairman Michael Saylor expects demand for bitcoin to double after the halving and the approval of spot bitcoin ETFs.

What do you think about the advice by Rich Dad Poor Dad author Robert Kiyosaki? Let us know in the comments section below.

from Bitcoin News https://ift.tt/4zrKjWn

Comments

Post a Comment