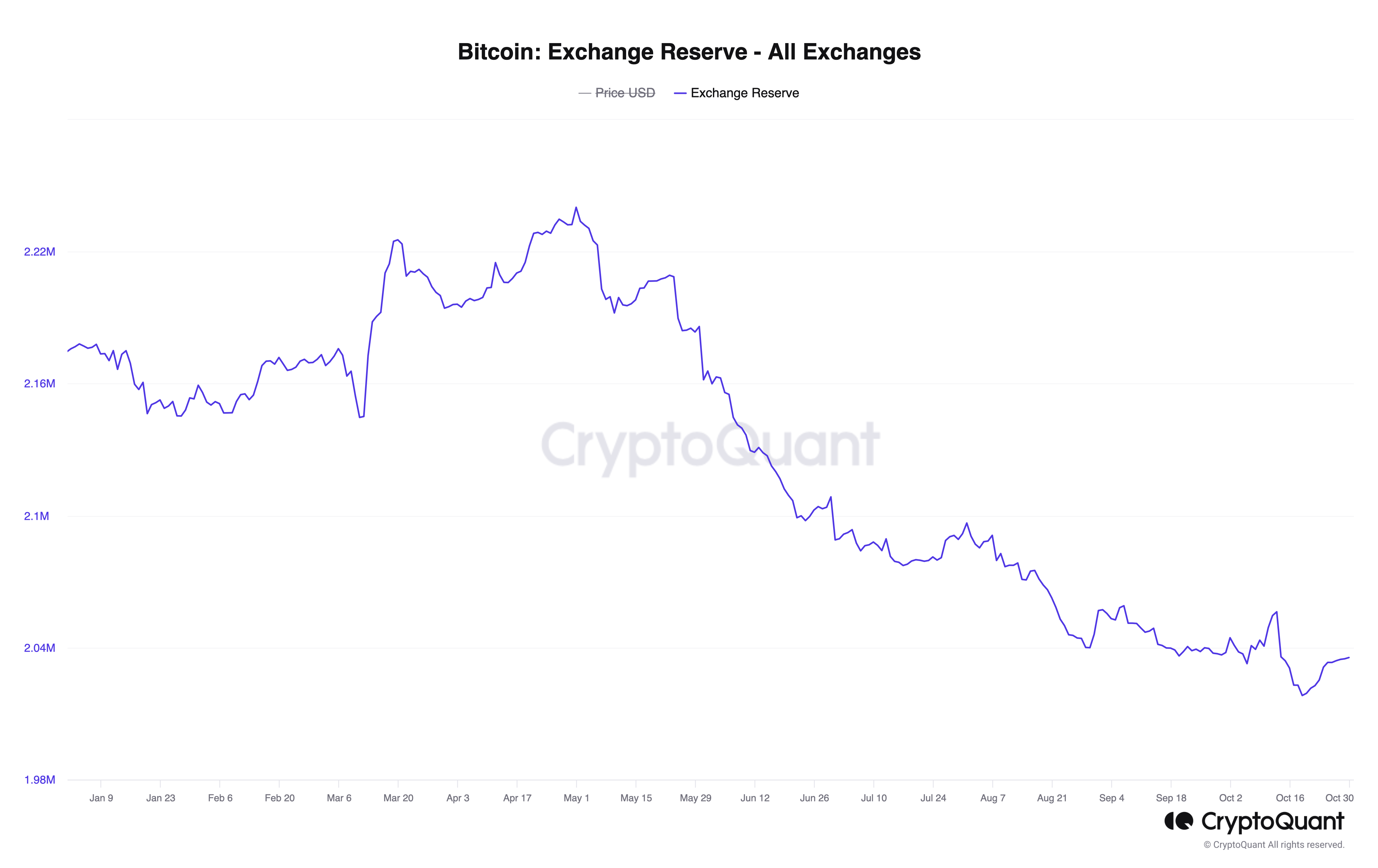

About 60,000 bitcoins valued at just over $2 billion were removed from trading platforms in the past 90 days. The number of bitcoins on centralized exchanges is slightly more than 2 million. A recent report from Falconx says swings in the market have been exacerbated by a persistent lack of liquidity.

Crypto Exodus: Over $2 Billion in Bitcoins Pulled from Exchanges in 90 Days

The count of bitcoins on centralized exchanges has plummeted to a multi-year low, with a mere 36,000 BTC exceeding the 2 million mark. This starkly contrasts the 2.513 million BTC stashed on trading platforms as of November 5, 2022.

Within a span of under a year, exchanges saw a reduction of 477,000 BTC. Fast forward to July 31, 2023, and about 2.096 million bitcoins were held on these trading platforms. This implies that, at current BTC exchange rates, a hefty sum of $2 billion in bitcoins, or 60,000 BTC, has been withdrawn from these platforms.

The same can be said about the number of ethereum (ETH) kept on centralized exchanges. Data from cryptoquant.com indicates that on November 5, 2022, there were 23.14 million ETH held on trading platforms.

On October 30, 2023, the count of ether is down to 14.57 million, which means 8.57 million ethereum worth $15.64 billion have been removed from exchanges in less than a year. Stablecoins too have been taken off exchanges or redeemed by the central issuers.

Exchanges that held $35 billion in stablecoin assets last November now have only $17.34 billion. This indicates more than $17 billion in ERC20-based stablecoins were either redeemed or removed.

The lack of liquidity might be behind the recent volatility in the cryptocurrency market. A Falconx report on Monday, citing Coin Metrics data, says the crypto market’s depth in 2023 has reached its lowest point. With bitcoin’s halving approaching, these liquidity cycles may get deeper.

What do you think about the lower amount of crypto assets held on exchanges over the last 90 days and year? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/21ufnOe

Comments

Post a Comment