Robert Kiyosaki Expects Bitcoin to ‘Become Priceless’ When the Fed Launches Central Bank Digital Currency

Rich Dad Poor Dad author Robert Kiyosaki has predicted that bitcoin will “become priceless” when the Federal Reserve launches a central bank digital currency (CBDC). He warned that privacy will be destroyed, emphasizing that “Big Brother will be watching.” The famous author urged investors to start accumulating bitcoin now “before it’s too late.”

Robert Kiyosaki’s CBDC Warning, Urges Investors to Start Saving Bitcoin Now

The author of Rich Dad Poor Dad, Robert Kiyosaki, has warned about the risks of the Fed launching a central bank digital currency (CBDC). Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

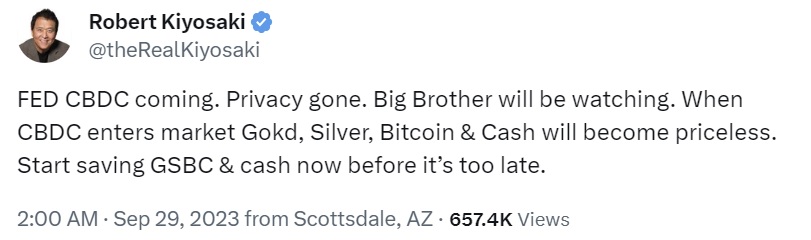

Kiyosaki explained in a post on social media platform X Friday that the Federal Reserve’s central bank digital currency is coming and when that happens, privacy will be gone. “Big Brother will be watching,” he cautioned, adding that when the digital dollar launches, gold, silver, bitcoin, and cash will become priceless. He proceeded to urge investors to start saving gold, silver, bitcoin, and cash now before it is too late.

The renowned author is not the only one who is concerned about the Federal Reserve launching a central bank digital currency. Last week, the U.S. House Committee on Financial Services passed the CBDC Anti-Surveillance State Act with the support of 60 Congress members. “This bill is simple: It halts the efforts of this Administrative State under President Biden from issuing a financial surveillance tool that will undermine the American way of life,” explained Congressman Tom Emmer (R-MN) who introduced the bill. In March, U.S. Senator Ted Cruz similarly introduced legislation to prohibit the Fed from developing a direct-to-consumer CBDC.

However, the Fed is a long way from issuing a CBDC. In September last year, Federal Reserve Chairman Jerome Powell stressed that the central bank has not reached a decision on whether to issue a digital dollar. “We have not decided to proceed and we don’t see ourselves making that decision for some time,” he noted. “We see this as a process of at least a couple of years where we are doing work and building public confidence in our analysis and in our ultimate conclusion.”

Do you agree with Rich Dad Poor Dad author Robert Kiyosaki regarding the Fed’s central bank digital currency and bitcoin becoming priceless? Let us know in the comments section below.

from Bitcoin News https://ift.tt/CguGqy4

Comments

Post a Comment