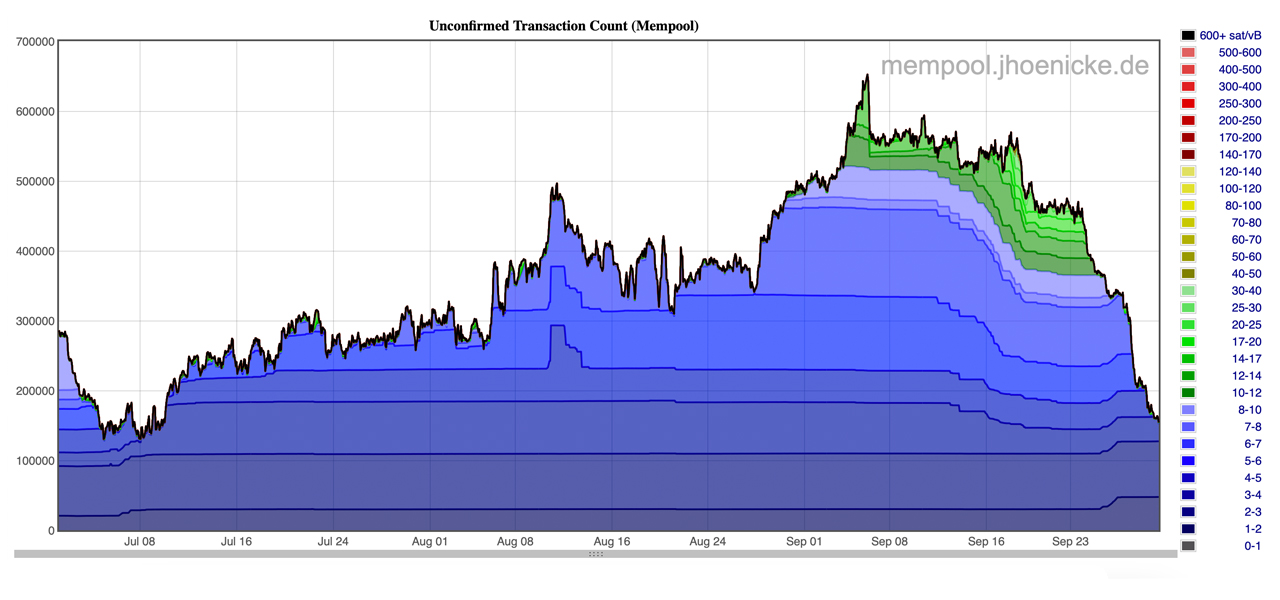

Bitcoin miners have been steadily clearing the mempool of unconfirmed transactions since the number almost reached 700,000 on September 6, 2023. Currently, the number of unconfirmed transactions has dropped to just over 153,000 pending confirmation.

Transaction Backlog Shrinks as Bitcoin Miners Face Fewer Inscriptions

On September 15, 2023, just over 500,000 unconfirmed bitcoin transfers lingered, awaiting miner confirmation, a decrease from the nearly 700,000 a week prior. Yet, as the curtain fell in September, the tally of unconfirmed transactions dwindled to a smidge over 153,000.

Data from both mempool.space and Johoe’s mempool statistics reflect that a substantial portion of the unconfirmed transfers have been processed. A couple of factors have augmented the miners’ capacity to navigate through the immense sea of unconfirmed transactions in the queue.

Firstly, block times have been shaving off a fraction of their 10-minute average, clocking in at around 8 minutes and 48 seconds as of this writing. Secondly, the tally of Ordinal inscriptions has seen a significant dip since September 25.

On that day, a mere 31,251 inscriptions were processed, a stark contrast to the 232,104 handled just a day prior. With a dip in inscriptions, the Bitcoin blockchain is processing significantly fewer transactions since hitting an all-time high earlier this month.

On the very day a mere 31,251 inscriptions were processed, miners confirmed 285,750 transactions. Come the next day, miners upped the ante a hair, confirming roughly 309,789 transfers.

Currently, data indicates a lingering 103.98 megabytes (MB) of block space awaiting confirmation, translating to about 54 blocks. Since April 22, 2023, the mempool hasn’t completely cleared, yet with the ongoing pace, there’s potential for it to clear sometime next month, provided daily inscriptions maintain their lower-than-usual trend.

What do you think about miners clearing the transaction backlog? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/IO9h6bs

Comments

Post a Comment