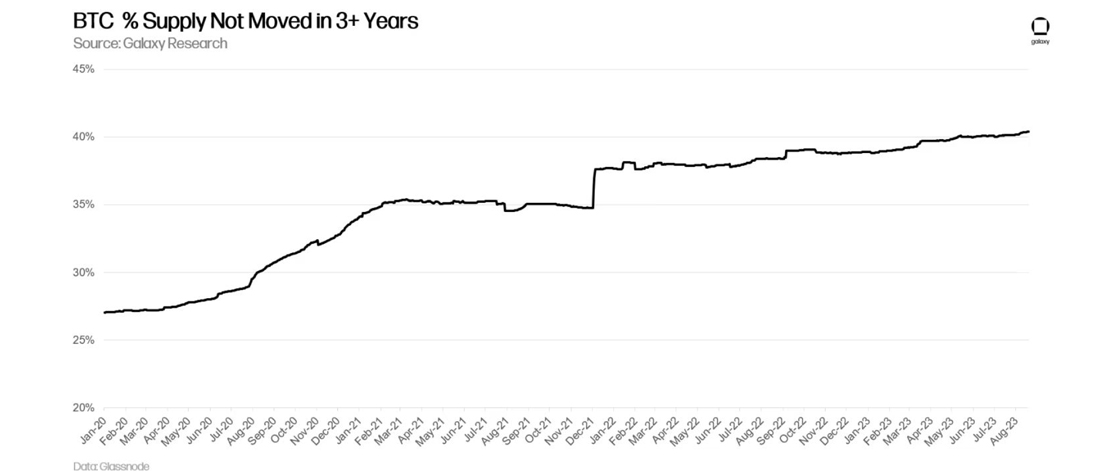

While Bitcoin’s recent downturn suggests volatile times ahead, underlying metrics suggest a market full of nuance, anticipation, and strong belief, the latest Bitfinex Alpha report says. About 40% of Bitcoin’s total supply has been inactive for more than three years — the highest ever for this measure, highlighting the top cryptocurrency’s strong base of holders.

Diamond Hands: Bitcoin’s Long-Term Believers Remain Resolute Despite Recent Tumult

The Bitfinex Alpha report shows a closer look at Bitcoin’s supply dynamics reveals compelling details. The one-year inactive supply, which means coins that have been dormant for at least a year, seems to mirror BTC’s price changes with remarkable accuracy, possibly acting as a gauge for volatility.

Before the sharp price drop on August 17, 2023, the one-year inactive supply decreased dramatically from 13.45 million to 13.32 million, possibly indicating the upcoming drop. However, a broader view tells a different story. Bitcoin’s metric for supply inactive for more than three years continues to rise, recently reaching a record high.

An examination of “Coin Days Destroyed” after the crash shows little activity from old coins, emphasizing holders’ commitment to waiting. Bitfinex researchers observed that these holders have been steadily amassing more coins over time.

“It’s clear that long-term bitcoin holders have been consistently accumulating,” Bitfinex’s researchers say. “Specifically, over a rolling 30-day period, this accumulation trend has been evident since March 2023. This behavior suggests a general feeling of optimism and potential resistance to market fluctuations.”

At the same time, Bitcoin miners continue their work, pushing the network difficulty to 55.62 trillion hashes in August — the highest ever. This computational power safeguards the network and rewards miners for their trust. Adding to this, Bitcoin’s hash rate surpassed 414 terahash per second (TH/s) in August, marking a 60% increase since January, the Alpha report points out.

Still, the report indicates that, by historical standards, volatility measures are subdued. Implied volatility has calmed since the August 17 drop, aligning with mild historical volatility. The one-year Bitcoin Velocity metric, which tracks onchain activity, dropped earlier this year, potentially signaling a pause. Though challenges may be on the horizon, underlying metrics reveal a diverse set of actions ready to influence its next phase.

“In conclusion, while holders from as far back as three years ago or more who have held their bitcoin throughout the bull market peak and bear market remain relatively resilient with their stack, ‘newer’ long-term holders who acquired their spot positions over the bear market are now ‘unsettled,’ but not in a state of panic,” the report concludes.

What do you think about the latest Bitfinex Alpha report? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/UAbgIVC

Comments

Post a Comment