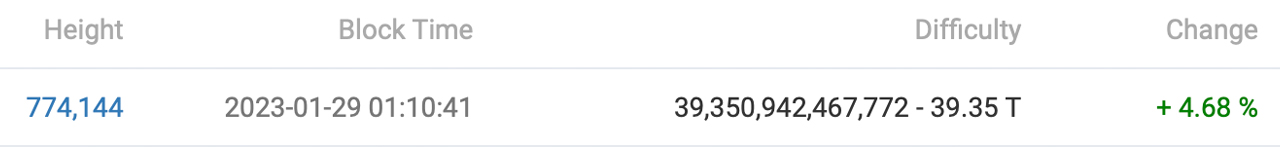

The Bitcoin blockchain recorded another difficulty increase on Sunday, Jan. 29, 2023, at block height 774,144. The network’s difficulty increased by 4.68%, from 37.59 trillion to an all-time high of 39.35 trillion.

Bitcoin Difficulty Reaches New All-Time High as Mining Gets Tougher

Bitcoin’s difficulty reached another all-time high, surpassing the record set two weeks ago, after rising 4.68% on Sunday. The increase occurred at block height 774,144, at 6:10 a.m. (UTC). The difficulty is now at 39.35 trillion, close to surpassing 40 trillion. The next adjustment is due Feb. 11, 2023.

The rise makes mining blocks more difficult, following a 4.68% jump after the 10.26% increase on Jan. 15, 2023. Jan. 29 statistics show a hashrate of 279.7 exahash per second (EH/s) over the last 2,016 blocks, currently at 283.55 EH/s dedicated to the Bitcoin blockchain.

Statistics from macromicro.me on Jan. 28, 2023, estimate the cost of BTC production at $21,176 per unit. On Jan. 29, the spot price was $23,584. With spot prices higher than the cost of production, bitcoin (BTC) miners have recouped some losses from the end of 2022.

Pool distribution calculated by blocks discovered shows Foundry USA as the top mining pool with 101.47 EH/s, equating to 34.89% of the network’s hashpower. Antpool has 57.54 EH/s, or 19.79% of the total network hashrate. F2pool, Binance Pool, Viabtc, Btc.com, and Braiins Pool follow Foundry and Antpool, respectively.

With the increase in difficulty, block intervals, or the time between each BTC block, have been about 9:02 to 9:38 minutes. This is slower than the recent 8:54 to 9:31 minutes recorded two days ago, but still faster than the 10-minute average.

What impact do you think the increasing difficulty of the Bitcoin network will have on miners and the cryptocurrency industry as a whole? Share your thoughts in the comments section below.

from Bitcoin News https://ift.tt/PhGNsfI

Comments

Post a Comment